Most investment gurus would have you believe that you need to trade a lot and own a lot of securities to become wealthy. But is this really true?

The analysts from Casey Research proof this is not the case, they give a clear example that one very well-informed investment decision per decade is all you need to retire with a small fortune. And we’re not talking about stock picking here, buying a stock like Microsoft (MSFT) at its IPO would have given you a 30,138% gain, but picking these kind of winners is really hard. The example from Casey isn’t about becoming lucky by buying winners but about having lots patience and identifying major economic trends early.

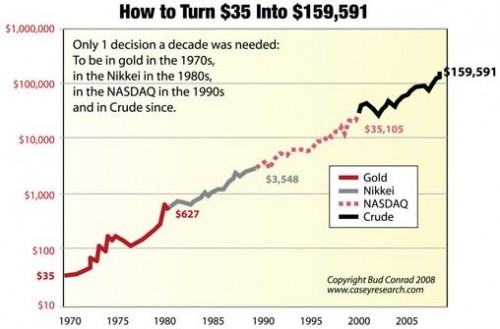

The story starts in 1970 with the purchase of one troy ounce of gold for $35. In January 1980 the price of gold hit a peak of around $850, but in this example the gold is sold at $627 and invested into the Japanese Nikkei index. One decade later it’s time for the next investment, the Nikkei went up more than fivefold and the initial capital of $35 was turned into $3,548. This money could then be invested in the NASDAQ and sold for a tenfold profit in 2000. Oil or gold were a good place to put the tech money into, an investment into oil would have given you close to $112,336 while an investment in gold would have quadrupled your investment to $134,081.

Basically, if a young guy in the 1970s identified these trends he could have turned $1,000 into over $3 million by the time he retired. Here’s the chart from Casey Research, they reached a higher number as they wrote this report in 2008 when oil was still trading over $100. Now the challenge is to identify the trend for the next ten years 🙂